To succeed as an entrepreneur, not only do you need “savoir faire”, you also need what we call “faire savoir”: the ability to share the right information, at the right time, with the right people. Unfortunately, this is a skill that many entrepreneurs lack. Even those who have good communication skills can sometimes neglect background information and risk undermining their credibility. This article is therefore meant to help entrepreneurs synchronize their achievements and communications and use informational leverage to their advantage.

Leverage is at the heart of the financial management of a company. It gives entrepreneurs access to extra funds by allowing them to take on more debt while only investing minimum equity. Informational leverage is in some ways similar to financial leverage. In other words, when entrepreneurs know how to use informational leverage, they can impact investors’ belief in the profitability of idea, even when they have little evidence to prove it.

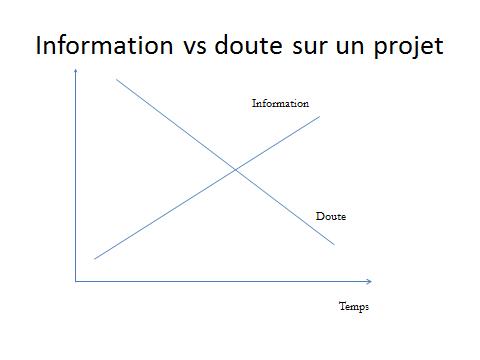

To understand the benefits of informational leverage, entrepreneurs should take into consideration the inverse relationship, summarized in the chart below, between the information available on a project and doubts about its chances for success or failure.

In the early stages of the entrepreneurial process, the support of outsiders is needed in order to ensure success. However, outsiders have very little objective information at their disposal in order to assess the existence of a market opportunity, the adequacy of the business model or feasibility of the business plan. As the company shapes, the amount of available information increases thus decreasing uncertainty about the outcomes. Later in the entrepreneurial process, the successful entrepreneur has been able to demonstrate the viability of the new venture and there is no more room left for doubt.

Informational leverage is therefore most useful during the initial phase, when an entrepreneur has yet to demonstrate tangible achievements. In fact, during this phase, the entrepreneur is sometimes the only one to believe in the viability of the project. He or she has to be prepared to convey that belief in only a few minutes, sentences or paragraphs, and must therefore be able to select the right pieces of information to share, and which will have maximum leveraging capacity.

To better understand the concept, let’s look at a hypothetical, but realistic example. A medical researcher needs funding for an innovative research program on Alzheimer's disease. If he or she simply explains to investors or potential strategic partners that the disease is a big market, unfortunately growing, this piece of data will have very little informational leverage. This information is public and does not give any advantage to the one who knows. In addition, and this is the most important point, the existence of a large potential market says absolutely nothing about the researcher's ability to identify an innovative therapy. However, if the researcher said he worked in the past with a team that developed an innovative therapy for a different disease; this piece of information has a positive informational leverage. Previous experience, even if it took place in a different field, increases the credibility of the researcher. Suppose now that our researcher is able to say that he published scientific articles on Alzheimer's and that he had obtained encouraging results in animal experiments. The leverage effect of such information on the belief of investors will be even greater.

In this example we must remember that entrepreneurs, especially those operating in fields where there is less certainty than in medical research, should know how to identify the information that can be leveraged and not waste time, and possibly money, collecting or sharing low leverage information.

So, how does one identify high leverage information in order to highlight it in a written or oral pitch? First, an entrepreneur needs to identify the biggest sources of doubt amongst potential investors or other kinds of audiences. With this understanding, he or she can sort through everything they know or have done in the past, in order to better draft a pitch that will be more likely to increase the credibility of their business plan.

However, when an entrepreneur has no information likely to reduce doubt, he or she should take the time needed to produce high leverage information before approaching investors, clients, bankers, or other partners. For example, if an investment fund is known for never investing in a new venture before a proof of concept has been made, pitching prematurely will be a waste of time. Entrepreneurs must first determine the minimal effort needed to prove their concept.

If a young entrepreneur, without work experience, knows that potential investors doubt his ability to build and lead an organization, he would need to include reassuring information on this point in his pitch. For example, he could choose to partner with an experienced leader who will play the role of Chief Executive Officer (CEO). He could also integrate into the business plan the recruitment of experienced managers. Another option would be to use the services of a paid mentor, or an advisory board. As information comes at a cost, the entrepreneurs should identify that piece of information that will have the maximum impact on beliefs: in this case, the most convincing option would be to recruit a CEO and share ownership of the venture but this information also has the highest cost.

Leverage is at its highest level when information costs very little to the entrepreneur. In our hypothetical example, this would be to announce an intention to set up an advisory board. However, investors will be able to see through this kind of move from a mile away: they expect the entrepreneur to opt for the least expensive option in order to maximize informational leverage. Therefore, entrepreneurs should find a fair compromise: provide the minimum amount of credible information (related to the market, technology, business model or team) that will maximize the belief in the success of their project and secure backing from needed partners.

Deciding what minimum information to share can have practical consequences on a new business: some information can limit an entrepreneur’s independence vis-à-vis their investors or other partners and should not be shared unless this is absolutely needed. For example, if the business is on the verge of receiving a large order but some investors are already willing to back it under fair terms without having this information, the entrepreneur would be wrong to share it right away. By keeping the information to himself, he maintains credibility - just in case the order doesn’t end up going through. If the order is signed, this information will be a positive surprise for investors and justify their belief in the entrepreneur’s project, after the fact.

To identify points with highest informational leverage in their venturing process, entrepreneurs should first test their project on a few individuals – before going to the investors or clients they have their sight set on. This will give them the chance to fine-tune their argument, identify informational gaps, and address key partners with the highest impact information about their venture.