From the article Is Bitcoin the New Digital Gold? Evidence from extreme price movements in financial markets (2018) by Gkillas Konstantinos (University of Patras) and François Longin (ESSEC Business School)

Gold: a Safe Haven Against Adverse Price Movements

Extremely volatile periods and therefore extreme adverse events in financial markets always constitute a dramatic experience for investors leading to bankruptcies, since a large amount of money changes hands. During such periods, portfolio diversification is of the essence for asset managers, financial advisors and investors so as to monitor the risk level of their positions. In order to reduce portfolio riskiness, the most commonly used strategy is a position in secure assets. The most common and known asset for this purpose is gold. The yellow metal has been considered to be a safe investment choice for portfolio diversification and portfolio hedging against adverse price movements with the passing of time. The explanation for this is rooted in the safe haven capabilities of gold over time. Gold presents high liquidity, is universal and internationally accepted in transactions providing significant diversification benefits to traditional asset classes. Furthermore, gold has proven its importance as a safe haven when a crisis happens, even in periods of the menacing erosion of the monetary or banking systems.

The Bitcoin Boom

Quite recently, Nakamoto (2008) (1) introduced Bitcoin. Ten years after his seminal paper, Bitcoin still continues to dominate the financial world. Bitcoin is an online communication protocol using a virtual currency, with the addition of electronic payments. This cryptocurrency is increasingly gaining popularity among both individual and institutional investors. Basically, Bitcoin has emerged as something “new”. Despite not being the only cryptocurrency available, Bitcoin is still the largest with regard to market capitalization and the most known cryptocurrency. What is more, Bitcoin has drawn the attention of both academics and practitioners in several fields ranging from statistics to risk management and asset management.

In Case of… Extremely Adverse Events

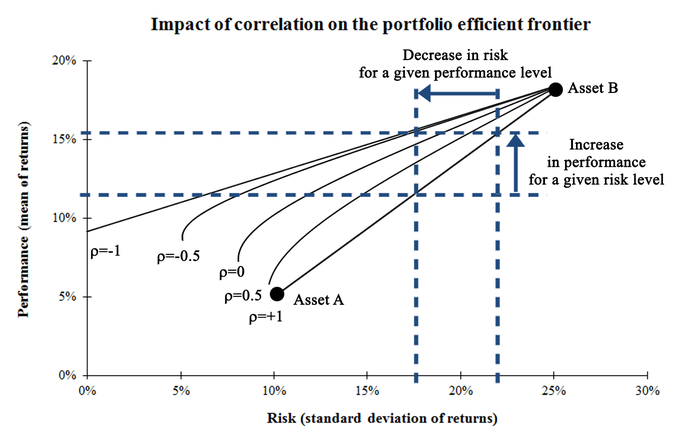

But are there any potential diversification benefits of Bitcoin during extremely volatile periods, especially in case of stock market crashes? In finance, we model asset returns with two parameters: expected return and volatility (usually measured by the standard deviation). Correlation along with expected return and volatility is also a key element when building portfolios. The correlation is a statistical measure of the degree to which the two random variables – two asset returns in our research – are related. Correlation is measured on a scale of -1 to +1. A correlation equal to +1 indicates a perfect linear relationship between the two asset returns; they always move in the same direction. A correlation equal to 0 indicates no (linear) relationship between the two asset returns; they may move in the same direction or in a different direction when one asset return goes up, the other one may go down or up. A correlation equal to -1 indicates a perfect inverse linear relationship between the two asset returns; they always move in the opposite direction.

As illustrated in the figure below, the lower the correlation among assets, the higher the performance of the portfolio for a given level of risk, and the lower the risk of the portfolio for a given level of performance. In other words, as the correlation between the two assets decreases, the diversification benefits increase. Correlation is the key factor that drives portfolio diversification.

Among asset managers, an important issue is how to hedge their portfolios in turbulent times. We analyze the tail dependence structure of international equity markets, Europe and the United States, vis-à-vis Bitcoin and gold in a pairwise comparison. For the equity market in Europe (EU), we select the STOXX Europe 600 index (2), and for the equity market in the United States (US), we select the S&P 500 index (3). Both indices include the most heavily traded and liquid stocks with the largest market capitalization of their geographical zone.

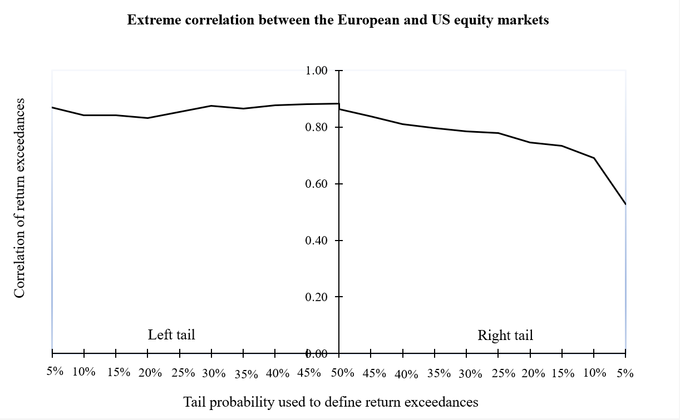

Step 1: Equity Markets

Several empirical studies (4) have argued that the extreme correlation (i.e. the correlation of extreme returns) increases during stock market crashes and decreases during stock market booms. This means that the correlation is not related to market volatility per se but to the market trend. The correlation increases in bear markets and decreases in bull markets.

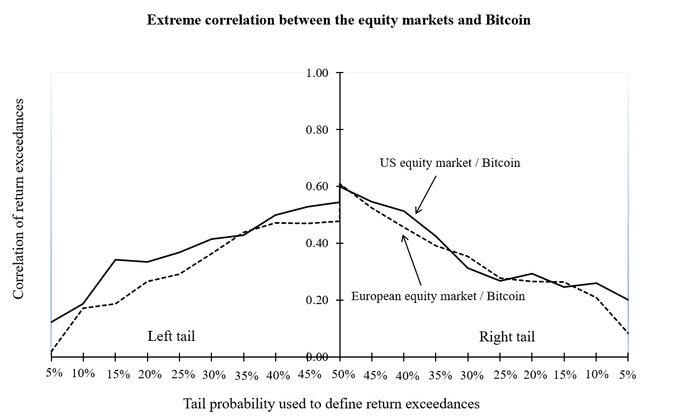

Step 2: Equity Markets and Bitcoin

Then comes the combination of each equity market with Bitcoin. The goal of the second step is to see if there are potential diversification benefits of Bitcoin over extremely volatile periods. Such benefits for investors can arise in case of a decreasing extreme correlation during market crashes.

The extreme correlation between the equity markets and Bitcoin is decreasing. Thus, Bitcoin can provide significant diversification benefits to investors.

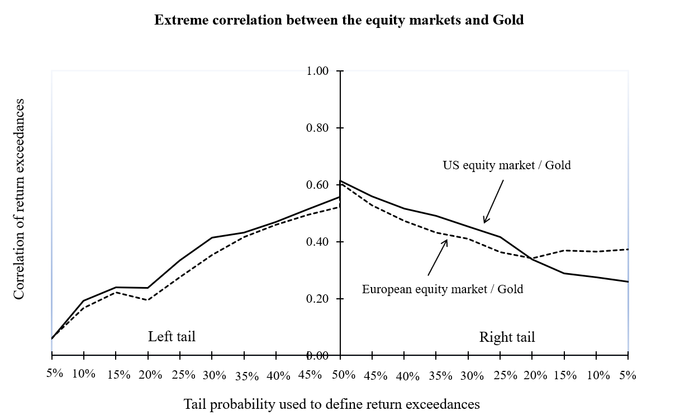

Step 3: Equity Markets and Gold

Afterward, we combine each equity market with gold. The goal is to corroborate the generally-held capability of gold as a safe haven throughout extremely volatile periods, particularly during stock market crashes. The extreme correlation between the equity markets and gold is decreasing as expected.

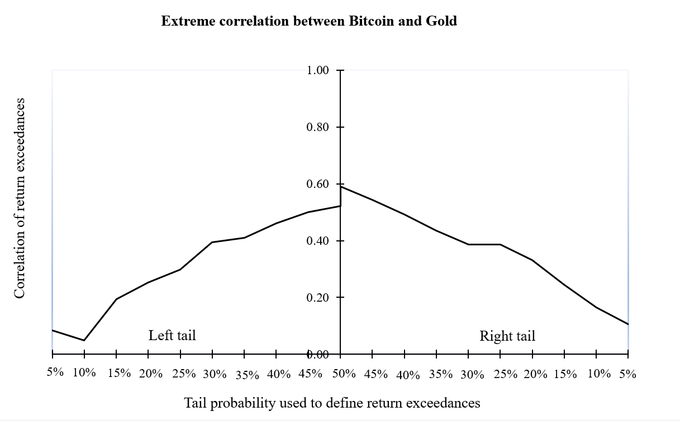

Step 4: Bitcoin and Gold

Finally, we consider a position only in Bitcoin and gold. The goal is to provide evidence whether both assets can be used together in a portfolio during extremely volatile periods. The concomitant use of these assets in a portfolio can be made if there is a decreasing correlation moving towards to the left distribution tail. The extreme correlation between Bitcoin and gold is decreasing.

This result implies that both assets can be useful together in times of turbulence in financial markets.

Bitcoin: the New Digital Gold

Bitcoin can be considered as the new digital gold as it presents a low correlation during extremely volatile periods, especially stock market crashes. However, gold is still important for portfolio risk management. Actually, both Bitcoin and gold can be used together (in the same portfolio at the same time) to provide diversification benefit for investors.

−−−

(1) Nakamoto S. (2008) “Bitcoin: A Peer-to-Peer Electronic Cash System”, Working Paper

(2) The STOXX Europe 600, also called STOXX 600, SXXP, is a stock index of European stocks designed by STOXX Ltd. This index has a fixed number of 600 components representing large, mid and small capitalization companies among 17 European countries, covering approximately 90% of the free-float market capitalization of the European stock market (not limited to the Eurozone)

(3) The Standard & Poor's 500, often abbreviated as the S&P 500, or just the S&P, is an American stock market index based on the market capitalizations of 500 large companies having common stock listed on the New York Stock Exchange or Nasdaq Stock Market. It is one of the most commonly followed equity indices, and many consider it one of the best representations of the U.S. stock market

(4) Longin F. et B. Solnik (2001) “Extreme correlation of international equity markets”, Journal of Finance, N°56, pp 651-678