With Gorkem Celik

Patricia Charléty, Professor of Economics and Finance, and Gorkem Celik, Professor of Economics at ESSEC Business School, look into the work of the Nobel Prize winners Bengt Holmström and Oliver Hart to expose how the contract plays the part of motivator.

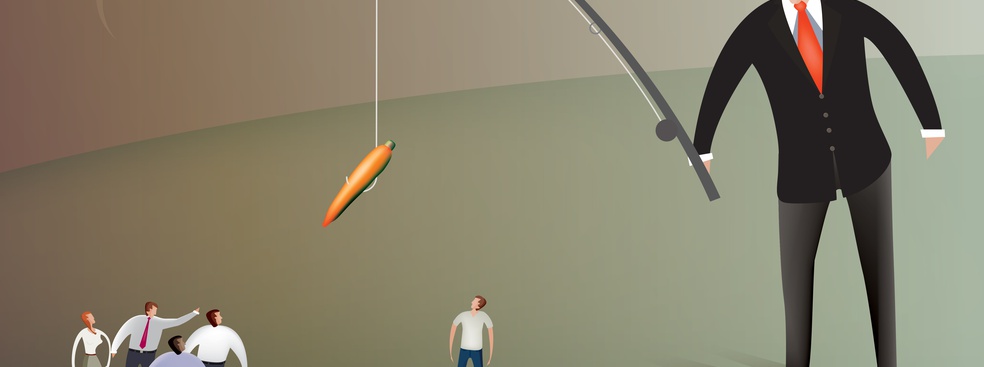

How can we make someone work for us? How can we entice them to exert an effort, when they are the ones to incur the cost of effort but do not directly enjoy its benefits? This year’s Nobel Prize in economics has been awarded to two researchers who made important contributions to our understanding of the answer to this question. Bengt Holmström and Oliver Hart’s research explains how people can use contracts to motivate others to make an effort to get things done.

Risk and how to manage it: the contract

Suppose you are the CEO of a bank and you want to explain to your clients the financial services that your bank can provide for them. Since you cannot talk to each of your clients by yourself, you need to motivate your employees, say the branch managers, to do the job for you. Unfortunately, you cannot directly observe the effort that a branch manager puts into this objective.

The problem that you face in this bank is moral hazard: The branch manager’s choice of actions is hidden from the CEO. Holmström’s informativeness principle (1979) suggests that, as the CEO of the bank, you should write an employment contract with your branch manager. Through this contract, you should link the manager’s compensation (her salary, the parameters for her promotion or the termination of her employment) to the observable performance parameters which are correlated with the manager’s effort. For instance, if you believe that the number of new accounts opened in the branch and the credit cards issued for the clients are good indicators for the branch manager’s effort, you should relate her salary to these measures. On the other hand, if you believe performance is only weakly correlated with effort, you should essentially pay a fixed salary. Basing compensation on observed performance subjects the manager to risk and calls for a risk premium. The optimal contract balances incentives and risk.

Keep a watch on the choice of incentives

Holmström’s research also highlights the difficulties in motivating people through this type of incentive contract. In his moral hazard in teams paper, Holmström (1982a) draws our attention to the fact that most tasks in the modern firm are performed through teamwork. So it is difficult to identify which team member is responsible for a bad performance: If a bank branch is not achieving its performance objectives, should we blame the branch manager for it or the bank tellers who have the first contact with the clients? In separate work, Holmström (1982b) reminds us that career concerns are another important source of motivation: Different measures are required to motivate employers in different stages of their careers. Younger employers are interested in their promotion opportunities within the firm and invest in their desirability for the job market in case that they want to change jobs in the future, whereas the older ones care more about the monetary incentives.

Holmström’s work with Paul Milgrom (1991) issues a warning call on a significant danger of using high-powered incentive contracts. In many cases, an employer wants an employee to exert effort in multiple tasks at the same time. The bank’s CEO may want the branch manager to try to sell financial products to the clients. But at the same time the CEO wants the manager to explain the drawbacks of these products such as higher account fees or higher interests rates on credit cards – so that the bank can build trust with the client which is necessary for their long-term relationship. Linking the manager’s compensation to the number of sold products only is detrimental to the second objective. This is exactly what we have experienced at Wells Fargo recently, where many of the bank employees opened fake accounts with disastrous consequences for the reputation of the bank.

The success of a higher education institution depends on motivating the professors to engage in high-impact research and teaching valuable skills to the students. Teaching activities are somewhat quantifiable via measurements such as the number of hours taught, the number of students registered in classes, and teaching evaluations. All this appraisal data is available to the school by the end of the academic year, whereas research activities take time to develop and to explain to the academic community. Indeed, it may take decades to appreciate the impact of good research. Moreover, it is worth noticing that the Nobel Prize winners of this year are acknowledged for the impact of the research they conducted more than 30 years ago. Rewarding professors excessively for the measurable aspects of their teaching performance may lead to a neglect of research activities.

Seeing is believing

The moral hazard problem stems from the unobservability of effort. In principle, when the effort is directly observable, the motivation problem could be solved by a complete contract describing exactly what each party should do and receive in any possible circumstance. However, there are many relationships in (and outside of) business life where parameters of performance cannot be written into such complete contracts since it is often impossible to foresee all relevant contingencies, or to enforce the terms of the contract. The theory of incomplete contracts, developed by Oliver Hart and his coauthors (notably Sanford Grossman and John Moore) addresses this specific situation. For example, in Grossman and Hart (1986), an upstream supplier and a downstream manufacturer should both make an effort (such as choosing the level of investment) for their mutual success. Even when the effort that each party puts into the project is fully observable to the other party, it may still be impossible for them to write a contract specifying who should be doing what: an action that is directly observable to these insiders may still be unobservable for a judge who will try to enforce the contract. In this case, the only realistic contract is a property contract, which designates an owner for each asset that may be useful for the continuation of the economic activity. Once they know the ownership structure of the assets, the business partners individually choose what type of effort to put into their joint endeavor and then they negotiate how to divide the proceeds from their joint activity.

Various ownership structures are possible – from separate ownership of upstream and downstream assets to complete integration. The theory of incomplete contracts gives a good recipe for the efficient allocation of ownership: each asset should be owned by the party whose (in-contractible) action brings the highest added value to the asset. Otherwise, if this asset is owned by someone else, this highest-added-value partner will restrain from taking the right actions since they may fear a “hold-up ” by the rightful owner of the asset: they may think that, after making the investment, they would end up with a small share of the added value since the owner of the asset has the outside option of terminating the relationship and using the asset for some other purpose. If assets are highly complementary, one agent should own both assets, whereas non-integration is best when one firm’s investment decision is less essential for the other firm. With separate ownership, each party has the option to refuse to trade and go on the market to find an alternative partner. Thus, Hart’s incomplete contracting model provides a powerful theory explaining why markets are critical for organizational choice.

The example of real estate

For example, if a company chooses to rent office space in Paris – La Défense – the rental market in this district of Paris is fairly dense and it can easily find a different property to rent if it does not agree with the property owner on the prolongation of the lease. In the case of such a disagreement, the owner can also rent this space to a new tenant using the ongoing market rent. In other words, neither party has the power to “hold up” the partner on the investment made for the maintenance of the property or for sustaining the excellent reputation of the company in question.

Public v. Private: In-house or outsource?

Hart’s theory on property rights has important implications on public versus private ownership. Most services financed by tax revenues, such as the police, national defense, education and the prison system, are provided by a public agency. In some other cases, the government chooses to contract with private suppliers. Garbage collection is an example. When should a government provide a service in-house or when should it contract with a private provider? Hart, Shleifer and Vishny (1997) combine the property rights approach with the multi-tasking theory of Holmström and Milgrom (1991) to examine this important question. A government may wish to make the best use of tax revenues and provide the service at a reasonable cost. At the same time, it also cares about quality. In this case, for example, quality stands for how well schools improve the general level of education or how well prisons treat inmates without focusing exclusively on the costs. Innovation can reduce production costs and improve quality. Since public managers of government-owned assets only obtain a fraction of the returns from their investments, they have limited incentives to innovate to reduce costs or improve quality. On the other hand, the private contractor gets full benefit from a cost-reducing innovation at the expense of quality and typically overinvests in cost reduction. In-house provision of government services dominates contracting when cost reductions have high negative effects on quality.

In this short note, we have tried to provide an overview of the contributions of Holmström and Hart to the theory of contracts by using familiar examples from firms and organizations. Contract Theory has many more important applications, notably in the fields of corporate finance and political theory. Indeed, 30 years on, and a Nobel Prize later, Holmström and Hart’s research still dominates the question of the contract as a means to motivate.”

For more information, interested readers are invited to consult the Nobel Prize website

Bibliography

- Grossman, S., and O. Hart (1986): The Costs and Benefits of Ownership: A Theory of Vertical and Lateral Integration, Journal of Political Economy 94, 691-719.

- Hart, O., and J. Moore (1990): Property Rights and the Nature of the Firm, Journal of Political Economy 98, 1119-1158.

- Hart, O., A. Shleifer, and R. Vishny (1997): The Proper Scope of Government: Theory and an Application to Prisons, Quarterly Journal of Economics 112, 1127-1161.

- Holmström, B. (1979): Moral Hazard and Observability, Bell Journal of Economics 10, 74-91.

- Holmström, B. (1982a): Moral Hazard in Teams, Bell Journal of Economics 13, 324-340. Holmström, B. (1982b): Managerial Incentive Problems: A Dynamic Perspective, in Essays in Honor of Lars Wahlbeck, Helsinki: Swedish School of Economics, re-published in Review of Economic Studies 66, 169-182.

- Holmström, B., and P. Milgrom (1991): Multi-Task Principal Agent Analysis, Journal of Law, Economics and Organization 7, 24-52.