Today, digital business is on everybody’s mind. But while marketing and information technology quickly come to mind, few are aware that digital technologies are also about to fundamentally change the management and design of supply chains.

The objective of supply chain management is to have the products and services available to the customer at the right time, in the right quantity, and at the right cost. But the traditional ways through which products and services are made available to the customer is set to be profoundly affected by new technologies.

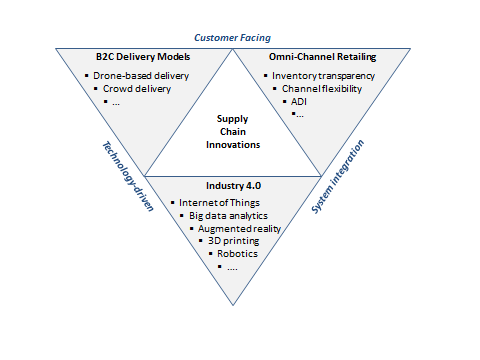

There are three areas where digital technologies currently play a disruptive role: Business to Consumer (B2C) delivery models, omni-channel retailing, and industrial manufacturing (and logistics) are set to be transformed by what is often referred to as Industry 4.0.

B2C Delivery Models

When Amazon revealed Prime Air, a future delivery service of customer orders by drone, it attracted widespread attention from the public. Others are working on the same technology. DHL runs a drone delivery service to the German island Juist. And start-up QuiQui is working on a service delivering medicine by drone directly to patients’ homes.

Drones are only one of many innovations in the sphere of B2C delivery. DHL, Amazon, and Audi currently pilot a delivery service where parcels are delivered into the trunk of the customer’s car. Audi provides tracking and access technology for its cars while DHL is in charge of the delivery.

Even more innovation is expected from crowd delivery, which concerns the delivery of parcels by non-professionals. Walmart was probably one of the first to launch a crowd delivery program through which customers gain redeamable points by delivering online orders to neighbors. Other players such as RideShip or Myways are offering crowd delivery, independent of any retailer, where anyone can sign up to deliver parcels.

One might argue that participative delivery services never reach the same level of quality as professional delivery companies like La Poste or UPS. But crowdsourcing models - like AirBnB and Uber - have already successfully transformed their respective industries. And hybrid models may bridge the gap. The French startup DelEasy crowd-delivers shopping orders with semi-professional staff, thus combining the advantages of the sharing economy with those of professional delivery companies.

Omni-Channel Retail

While retailers have implemented multi-channel concepts in the last decade, these channels have not always been integrated. At many retailers, the e-commerce channel is separated from the brick-and-mortar business, and every channel has a separate supply chain.

In omni-channel retailing, all channels through which a retailer interacts with the consumer are integrated, be it internet, smart phone, or a physical store. IKEA shows the inventory level of its products in each store on its website. And the French sports retailer Decathlon allows its customers to buy products online that are available in a specific store. The order can be picked up by the customer or even be delivered directly from the store. Products that were bought online can be returned to any physical store and vice versa.

Omni-channel integration necessitates a new way of thinking for supply chain managers, who are used to consider inventory warehouse-by-warehouse with separate information systems. With omni-channel retailing, the network of stores becomes one integrated virtual warehouse and traditional logistics flows from warehouse to store are complemented with a multitude of micro flows from store to customer and back from the customer to the warehouse.

But omni-channel retailing and the tighter relationship with the consumer that comes with it also provide a basis for creative solutions to better match demand with supply. Grocery retailer Chronodrive offers its customers Izy, a small device attached to the fridge which records products that the customers intends to buy. The device recognizes the voice command and adds the product to the online shopping list of the customer. This does not only allow Chronodrive to guide customers to more profitable products (when the customer desires, for example, a beer it is the system that proposes a certain brand), it also allows for using these advance demand information to better predict customer purchases and to ship products to the right stores ahead of time.

Industry 4.0

Industry 4.0 concerns manufacturing and logistics and regroups a whole set of innovative technologies which are expected to propel traditional manufacturing to the digital area, such as 3D printing, the Internet of Things (IoT), industrial big data analytics, augmented reality, and robotics. The German Government estimates the business potential of Industry 4.0 for Germany alone at 20-30 billion Euros per year. Logistics services provider Bechtle Logistik uses augmented reality glasses from Vuzix to visually guide operators in the warehouse to the location where to pick up the next item and to directly scan the bar code of the item. Rockwell Automation offers a predictive maintenance system for the oil and gas industry, where smart and connected sensors transmit the operating status of each part of an oil rig to a control center which uses big data algorithms to predict equipment failures, saving millions of Euros of otherwise lost production. And shipping company Maersk pilots a project to equip its fleet of tankers with 3D printers to print replacements of broken engine parts – a process which otherwise requires the ship to interrupt its busy schedule, resulting in costly delays.

The potential applications of the above technologies are manifold. But the key question is how these technologies change the way supply chains are designed and managed. In what respect are they truly disruptive, rather than just being an evolutionary way to further improve operational efficiency?

I believe that digital technologies have the potential to change the way value is created in supply chains. Consider the example of 3D printing. This technology has already made its way into some niche markets, such as production of medical prostheses, airplane spare parts or personalized smart phone covers. In these segments, 3D printing can leverage its inherent strength to produce unique designs at zero setup cost. But to be truly disruptive, 3D printing has to leave its niche area and enter the mass market.

Local Motors, a US-based start-up, has announced that it will print passenger cars in micro-factories in shopping centers by 2020 – in front of the customer and according to her specifications. The customer drives home with a fully functional car. If this becomes reality on a large scale, the disruptive force on traditional supply chain management will be enormous. In such a supply chain, there would be no more finished goods inventory to store and to transport. Traditional manufacturing locations such as China and Eastern Europe may lose their competitive advantage as production becomes a commodity; a standard 3D printing facility close to the consumer’s home could print any product. Where is value created in such a supply chain? Maybe at the design stage rather than at the manufacturing stage.

At the moment, we can only speculate what will happen. But one thing is sure: The supply chain field has an exciting decade ahead.