The euro was created in January 1999, following a decision reached in 1991 (the Maastricht Treaty). The new currency needed a central bank to manage it – and the European Central Bank (ECB) was born, based in Frankfurt-am-Main, a hot financial place in the inflation-averse Germany. At this moment, in the fall of 2015, the Euro Area [EA] comprises 19 countries that have decided to adopt the euro as a legal tender. The region covers 340 million inhabitants, compared with 319 million inhabitants in the US. Its share in the World GDP amounts to 12.2%, compared with 16.1% of the US share and 16.3% of China’s share (PPP adjusted).

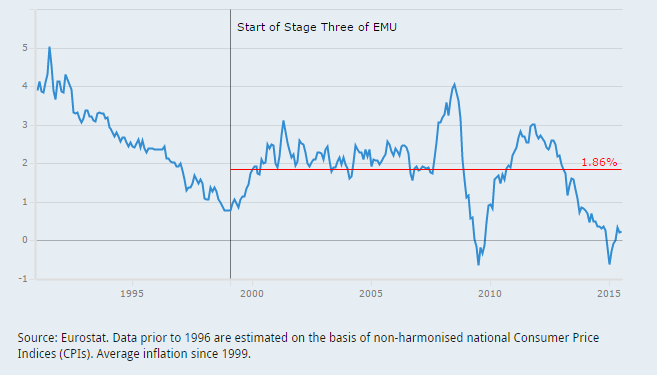

The overriding goal of the ECB, as stated in the Article 127(1) of the Treaty on the European Union, is to maintain price stability in the Euro Area. This goal was interpreted as keeping the inflation rate below but close to 2%. Calculated over the entire 16-year period, the average inflation rate in the EA is 1.86%, which is quite close to the target. Unsurprisingly, the volatility of the inflation rate has increased dramatically after 2007 (Figure 1).

Figure 1. Euro Area inflation rate, 1999-2015

The period from 1999 to 2007 was a blessed one. In all developed countries economic fluctuations were mild, and small adjustments in the short-term interest rates allowed central banks to restore the desired output growth path. Similar to many other central banks, the ECB followed the standard “lay against the wind” policy, raising interest rates when the economic activity was strong and pushing them down during a downturn, such as the dotcom crisis of 2001. In particular, such policy involved only small fluctuations in the “monetary base” or “high-powered money” made up essentially of commercial banks’ reserves. In the balance sheet of a central bank, reserves are thus recorded as a liability towards commercial banks.

The global financial crisis that hit the world economy in 2008 provided the first survival test for the ECB and the euro. While after 2009 the US, non-euro European countries, and the emerging economies could heal their wounds and slowly recover, in the Euro Area, the recession provided the catalyst for a new crisis, sometimes referred to as the “sovereign debt crisis”. Troubles begun in early 2010 when tensions in the Greek T-bond market spread rapidly to Spain and Portugal, and Ireland had to cope with the burst of its housing market bubble and the collapse of the banking sector.

This new crisis had two possible outcomes: 1) the end of the euro story and a return to national currencies; or 2) the continuation of the euro under a completely new organization of monetary policy in the Euro Area, with new missions for the ECB, including a major role in the pursuit of financial stability, and much greater responsibilities placed on national governments to maintain healthy public budgets. It is clear today that Europeans have opted for the second outcome, but the decision process was not smooth; at various critical moments, tough choices had to be made.

It might be interesting to recall some of the key ECB interventions. They demonstrate that sometimes the goals of financial stability, price stability and support of economic activity were aligned, and sometimes divergences subsided, and the ECB had to strike difficult decisions.

The first test of the ECB’s hidden ammunitions arrived as early as 2008 at the beginning of the Great Recession. After the collapse of Lehman Brothers in September 2008, doubts about the financial solidity of European banks edged up, with many banks facing major difficulties in rolling over short-term debts. The interbank interest rate was raised in an alarming way. A seemingly benign shortage of liquidity was at the point of suffocating banks. At that moment, the ECB managed to restore a normal situation by engaging in several longer term refinancing operations (six months initially, then one- year) with unlimited amounts of funds. For the first time since its creation, the ECB relaxed the principle of a conservative management of the monetary base, by agreeing on massive and harder to reverse increases in the monetary base. Without stating it explicitly, the ECB reached the conclusion that price stability only can be maintained if banks survive.

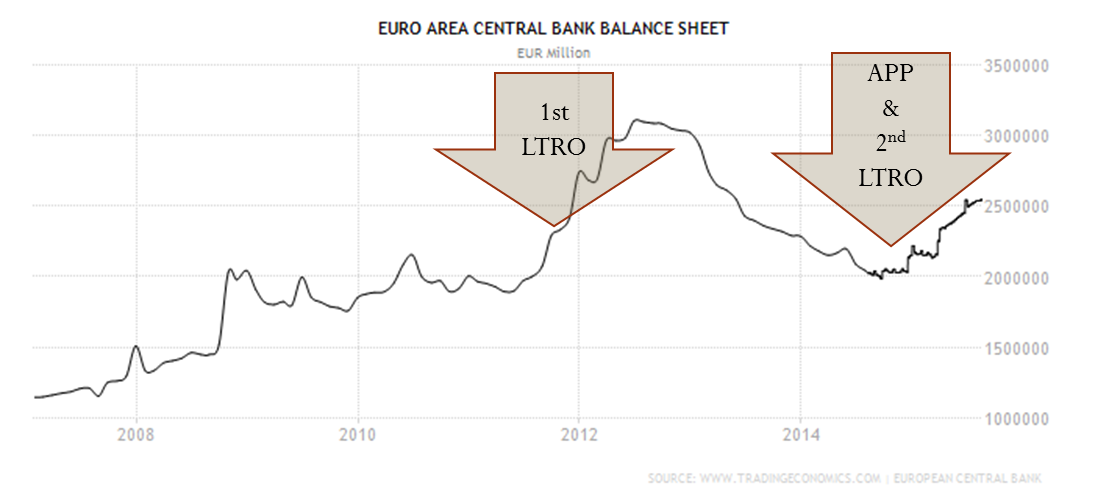

More relevant steps in the same directions were implemented in December 2011 and in January 2012. Against the background of the protracted slump in the Euro Area, under the spectrum of the Greek default, many Southern European countries faced major difficulties in rolling over their public debts. In particular, the situation of Spain and Italy was quite worrying, with interest rates on 10-year T-bonds reaching 7 to 8%. The ECB engaged in two Long-Term Refinancing Operations (LTROs), providing 1,000 billion euros to banks at a very low interest rate, thus doubling the existing monetary base. At a first step, the measure seemed able to calm down tensions in the public debt market after some banks bought T-bonds, but the positive situation did not last long. Furthermore, banks started to reimburse the initial loans by anticipation, and the monetary base shrunk again (See Figure 3).

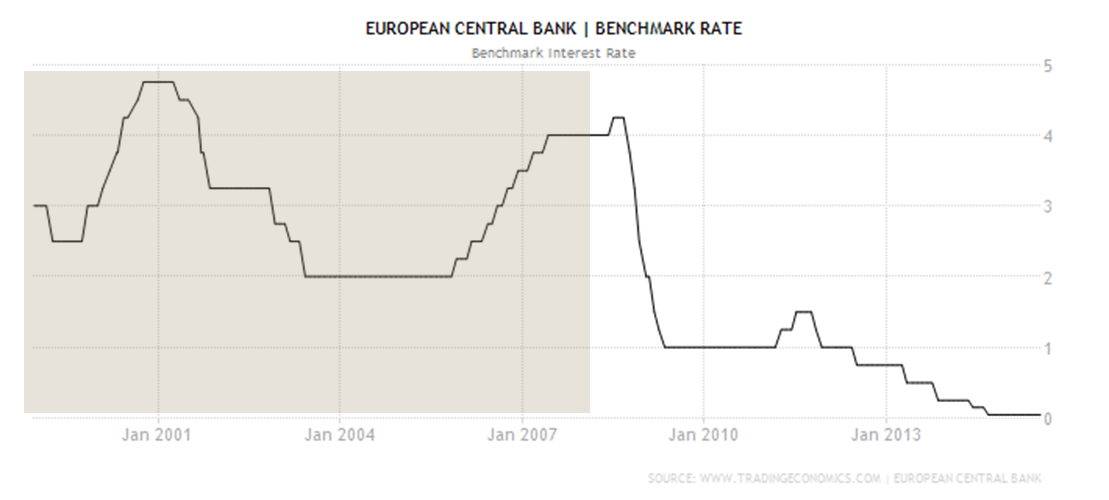

The key monetary policy instrument, the interest rate on seven-day repo loans to banks, was pushed down in successive steps, from a peak of 4.25% in July 2007 to 0.25% in November 2013 and then to 0% in September 2014 (See Figure 2). The main “weapon” of the ECB was therefore exhausted, and for approximately two years, the monetary policy has been navigating in the moody “zero bound” waters. Furthermore, in July 2013 the Bank committed to keep the target rate to very low levels “as long as necessary”. In addition to these loans, the ECB provides banks with two special facilities, allowing them to borrow or to park overnight funds. Since May 2014, interest rates on these excess reserves placed in the deposit facility of the ECB have been remunerated at negative interest rates (-0.20% since September 2014). At the same time, the economic outlook of the Euro Area has been bleak (growth in the EA in 2014 was as low as 0.8% - Eurostat data) and, worst of all, the price level has been falling (not only because of falling energy prices).

Figure 2. Key interest rate on short-term repo loans, 1999-2015

In the fall of 2014, the monetary base of the ECB was approximately 2,000 billion euros and falling. With the interest rates reaching the “zero-bound” and deflation looming, the ECB decided to change its strategy, towards a pro-active management of the monetary base.[1] In particular, Mario Dragi set up the target to increase the assets held by the Bank by 1,000 billion euros (about 50% of the prevailing stock).

For so doing, the ECB launched a new wave of (targeted) LTROs, conditional on commercial banks providing more loans, and an Asset Purchase Program (APP) consisting of purchasing approximately 50 billion euros per month in public bonds (start in January 2015) and about 10 billion euros per month in private assets (covered bonds and asset backed securities) until September 2016. The APP is inspired by the Quantitative Easing (QE) program as implemented by the Bank of England and the Fed (the US Central Bank) in the aftermath of the Great Recession. For instance, in the US, from 2009 to 2014 the Fed bought approximately 3.5 billion dollars in long-term public and mortgage agency backed bonds.

Figure 3. The Euro monetary base, 2008-2015

There is an important difference between LTROs and asset purchases. While the former are implemented at the initiative of the commercial banks which can borrow or not from the Central Bank, the latter has substantial control on the amount of assets it buys every months under the APP. The later measure is an extremely powerful tool for managing the monetary base. Some have criticized programs of public bond purchases as being tantamount to deficit monetization that led to explosive inflation episodes in the 70s. There is however one important difference that worth being emphasized – at that time, central banks were not fully independent and governments use debt monetization as a mean to finance their excessive spending. Today, it is the ECB which has the initiative of buying/selling bond, in a period of very low inflation, under strict rules, and with public deficits under control (2.6% of GDP in the EA in the first quarter of 2015).

Asset purchases could result in several positive outcomes. One expected consequence is holding long-term interest rates low, which should stimulate private investment. Low long-term rates are also beneficial to governments who will be able to refinance their debts in cheaper terms. With higher reserves, banks should ease credit conditions and grant more credits. Whatever the theoretical perspective, be it monetarist or Keynesian, the increase in the monetary base should ultimately result in higher inflation, thus opposing the deflationary trends observed in 2014-2015. In fact, immediately after the announcement of the ECB Asset Purchase program, against the background of the US closing its own program, the euro depreciated against the dollar, and some positive effects on the EU balance of payment were observed. Some improvement in credit supply conditions was also recorded. However, QE is certainly not an innocuous policy, and the experiences of the US Fed and the Bank of England are too recent to draw any definitive conclusion. The measure is probably difficult to reverse because selling bonds has an adverse effect on long-term interest rates and economic activity. A fall in the prices of bonds might entail large losses for the Central Bank. Finally, there is a risk that QE nourishes bubbles in asset prices (housing, art, stocks, etc.) instead of stimulating the “real” economy and raising prices of goods and services. The more modest program implemented by the ECB compared with the Fed seems to be the right choice, and the ECB should be extremely vigilant in monitoring side effects, such as abnormal increases in asset prices.

The last important move of the ECB we want to mention has less to do with price stability than with financial stability. We need to turn back in time to mid-2012. The two LTROs in the beginning of the year failed to stabilize bond markets, and this was probably not their main mission. After a very tough negotiation with reluctant governments in Southern Europe, in March 2012, Germany and Nordic allies managed to impose on all EU members the adoption of the Fiscal Compact. The Fiscal Compact is a set of rules, based on the model of the (RIP) Stability and Growth Pact, aiming to secure low public deficits (below 3% of GDP) and build a path for reducing public debts above 60% of GDP. Had the ECB agreed to monetize debts before this treaty was signed, this would have opened the door for unlimited opportunism of spendthrift governments and would have endangered the entire euro construction. Once the treaty was signed, the ECB recovered its full set of options. In an informal speech in July 2012, Mario Dragi pledged “to do whatever it takes to rescue the euro”. The next day, long-term interest rates on public debt in all distressed countries, mainly Spain, Portugal, Italy, Ireland, and even Greece, started a long downward journey. On September 9, 2012, the ECB provided the rules for a would-be bailout – the Outright Monetary Transactions Programme, confirming that the ECB will purchase bonds of the governments facing major borrowing difficulties under a set of tight conditions (including IMF supervised reforms). The magic of this measure is that, by breaking the chain of pessimistic expectations, it never had to be implemented. With falling interest rates, all of the countries facing difficulties at that time recovered investors’ trust and could set their debt levels on sustainable tracks. Ireland, Spain and Portugal were even able to end the special support from the European Fund of Financial stability long before target.

In the same line of action to support financial stability, since the end of 2014, the ECB took the responsibility for running the Single Supervisory Mechanism (SSM) that, next to the Single Resolution Mechanism (SRM), will set the basis for a genuine banking union in the Euro Area. It took two major crises and the near collapse of the European banking sector for national policymakers to agree to release their grip on national banks and open the banking sector to sound competition under uniform European rules.

Finally, the ECB is systematically urging governments to undertake structural reforms. In Spain and Italy, the governments have adopted measures of increasing labor market flexibility. Such reforms move in the right direction and should be followed by all Southern European countries. Monetary policy can a growth friendly environment, mainly by protecting price stability, but cannot be a substitute for price flexibility and factor mobility that are key ingredients of growth.

What lessons can we take home by observing the actions of the ECB during the last seven years, from the burst of the housing bubble in the US and the beginning of the Great Recession until today when the Euro Area is slowly recovering?

- During the crises, the ECB appeared as one of the most solid and internally consistent European institutions, a pillar for the stability of the Euro Area.

- The ECB can pursue efficient policies in line with the goal of preserving price and financial stability only if all governments run rigorous fiscal policies. This involves common awareness about the risks associated with high or increasing public debt. From a practical point of view, the Fiscal Compact must be strictly enforced in all the Euro Area countries.

- If the former conditions hold, the central bank can bail out a distressed government in exceptional times. Such commitment aims chiefly to keep risk premia under control and rule out inefficient multiple equilibria and may never be implemented.

- The ECB can pursue efficient policies in line with the goal of preserving price and financial stability only if the banking sector is resilient enough to cope with a substantial crisis. This can be achieved by a more competitive banking sector within a genuine European banking union, tighter prudential rules, and a mechanism for eliminating inefficient banks that should no longer benefit from state protection.

- If the banking union is established and functions properly, the central bank can also provide temporary support to an illiquid but solvent financial institution.

- The ECB should recover the normal operation process in monetary policy, based on the management of short run interest rates, as fast as possible. Two more years will probably pass before this normality is reached.

- Many of the ECB’s unconventional measures could only be adopted because inflation was extremely low and even negative. Everyone should be aware that in a high inflation context the central bank’s ability to support banks or governments through measures leading to increases in the monetary base would be drastically reduced.

The ECB has so far successfully passed the test of reality in a context where all of the shortcomings of the euro were revealed by an accumulation of negative shocks. The ECB has proven that it can secure price stability while at the same time paying due attention to financial stability and growth. Probably the most important quality of the ECB during this period was to be cautious, never acting in haste. So far, some of its measures can be criticized as being inefficient. Many were good, and none were harmful. Time will tell in which category the last measure, the ECB Asset Purchase program, belongs.

[1] See Panel remarks by Vito Constâncio, Assessing the new phase of unconventional monetary policy at the ECB, Annual Congress of the EEA, Mannheim, August 25, 2015.